2021 Saving to Invest challenge! Take Control of Your Finances!

Covid-19 has put all of us on the spot, and it affected all of us differently. However, it has also highlighted the fact that SAVING for a rainy day is so crucial to our survival for shelter and food.

Please, let’s not lie to ourselves, money is necessary, and saving is an indication of managing our money well. We save for emergencies, we save for next Christmas, or like me if you are an immigrant, you might want to save to visit your family and friends more often too. Unless we are expecting to rely on the government for our retirement, we also need to invest for our retirement. For me saving and investment to become independent in retirement is important.

Please, start saving now, there is no age limit, your future self will thank you.

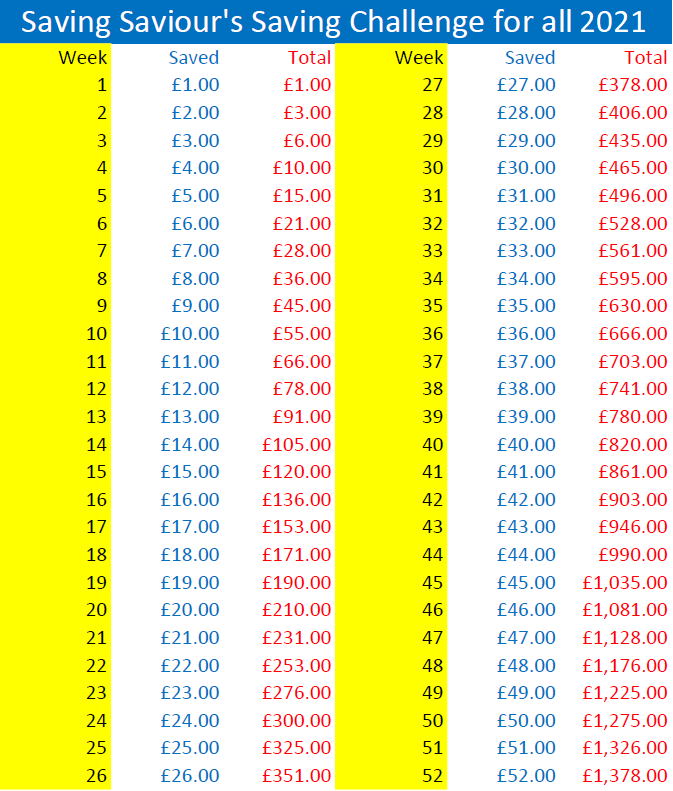

If you have noticed, this is my fourth year of the Saving to Invest challenge. I will top up my emergency savings before investing in my ISA.

Thank you.

Bertha

A little simplistic to average out annual savings by just increasing them by £1 a week.

One who is used to saving would firstly ask, what has changed in month 1 to only afford to save £10-15, and yet 11 months later in a position to save £202 all of a sudden, ironically if you’re basing this plan on a calendar, the 12 month of the year is usually one of the most expensive due to festivity spending.

Surely the best way to start would actually be to average out the savings per month throughout the year, and then increase the monthly average year on year. Maybe year 1 start with £50 a month, by year 4-5 you could be putting more than £100-120 a month a side without making it more difficult to save as you through the year?

Hi JOhn, this form of saving might not work for you. We each need to find a way that suits our saving methods. Regards.