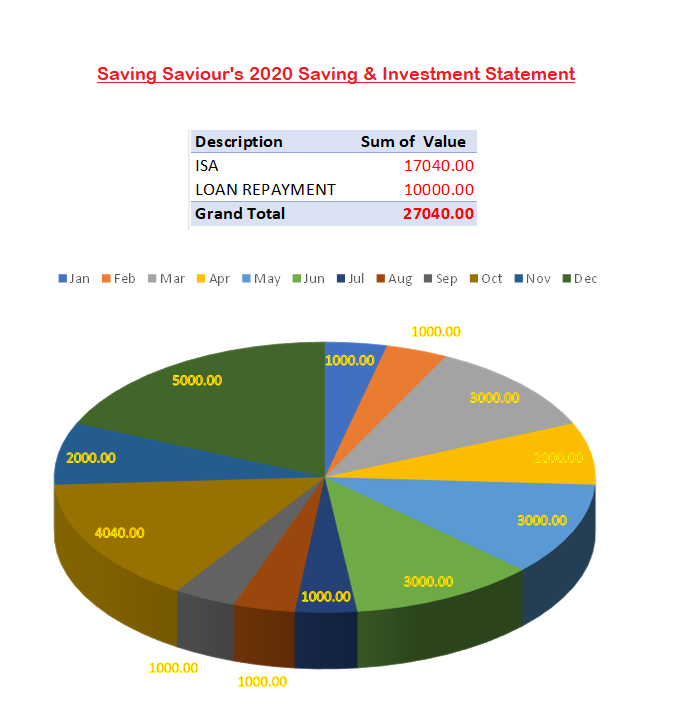

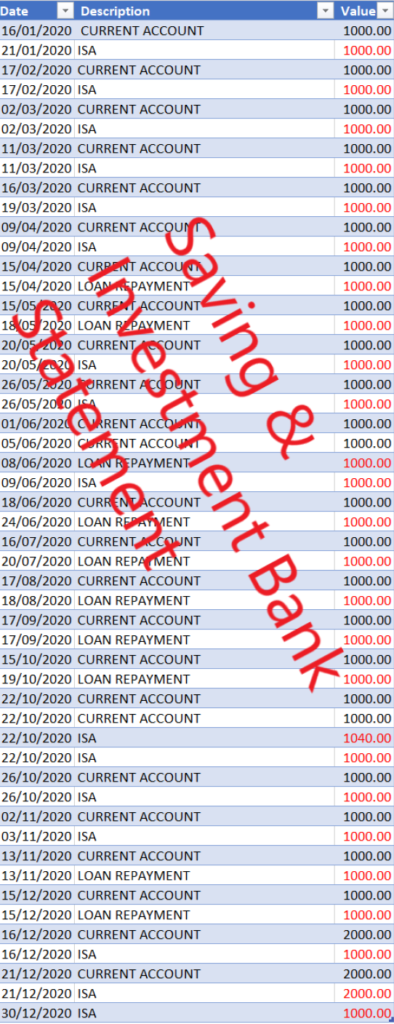

Wow! I didn’t realise I invested in my ISA stocks and shares so much as £17K this year! This is only £3K short from our yearly ISA investment allowance.

In the past two years, I had to borrow money to re-invest in my rental properties and this is why 2020 is showing a loan repayment of £10K too. My ISA investment is there when I need it for emergencies too, and I could have withdrawn the money to refurbish my rental properties, but I had access to “other people’s money”, and now I paid it back.

Ideally, I would like to be able to obtain cash advances from my rental mortgage lenders for such emergencies particularly when I have made mortgage overpayments over the years for such events. However, I spoke to my mortgage lender, and they refused me under the impression that I was going to use it to add it to my ISA investment. I felt their judgement was inaccurate, so this is why I had to borrow the money.

Now, I am building a separate emergency buffer for rental emergency repairs in a separate account.

Also, I have seen so many other people who pursue “financial freedom” topping up their 20K ISA allowance this year, perhaps Covid-19 has helped to save more due to not going out or going on holidays.

Thank you for reading.

Bertha.